Dear Azzilonians,

We are proud to launch this first edition of the Azzilonians Newsletter, your source for the latest investment trends and insights. Today, we’re focusing on a topic that’s been making headlines: the rising price of gold.

But before going any further, for those of you who may not be familiar with the term Azzilonian here is the definition.

Azzilonian (noun): An individual or entity that is part of the Azzilon community, either through direct involvement or support. This includes clients who utilize Azzilon’s services, investors who provide financial backing, employees who contribute to the company’s operations and growth, business partners who collaborate with Azzilon for mutual success, and supporters who believe in and advocate for Azzilon’s mission and values. An Azzilonian is characterized by a shared interest in Azzilon’s endeavors and a

commitment to the advancement of its goals.

Azzilon’s on-going product development

Azzilon is preparing some interesting gold-related products with a few global banks, and we are also exploring the creation of a Smart Gold ETF to be listed on the TSX. We will soon update you on this.

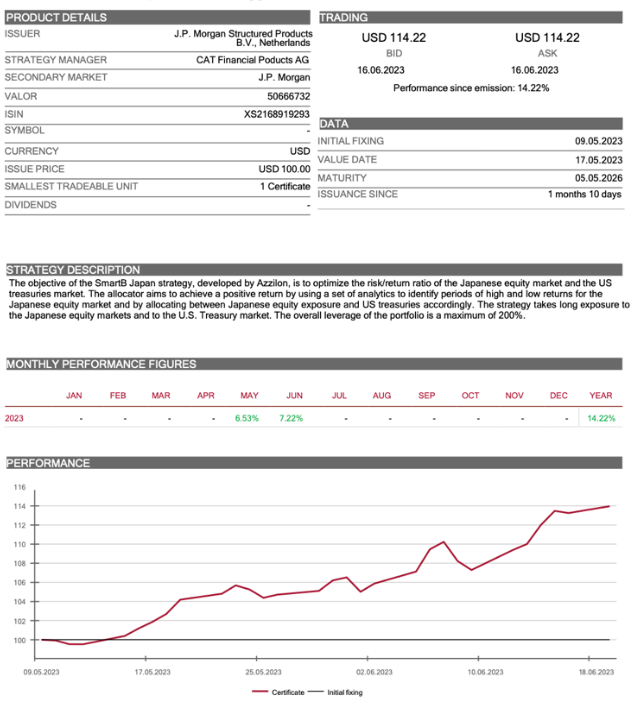

Last month, we built an index for JP Morgan related to the Nikkei 225. It is now tradable as a bank note and already generated a performance of 10% last month. This algorithm is based on a layering process. We also built a systematic portfolio resilient to recession for a Morgan Stanley’s defensive product. We are now working on a Dow Jones Market Neutral Strategy which should be launched before the end of summer. This one is now being reviewed by UBS Bank.

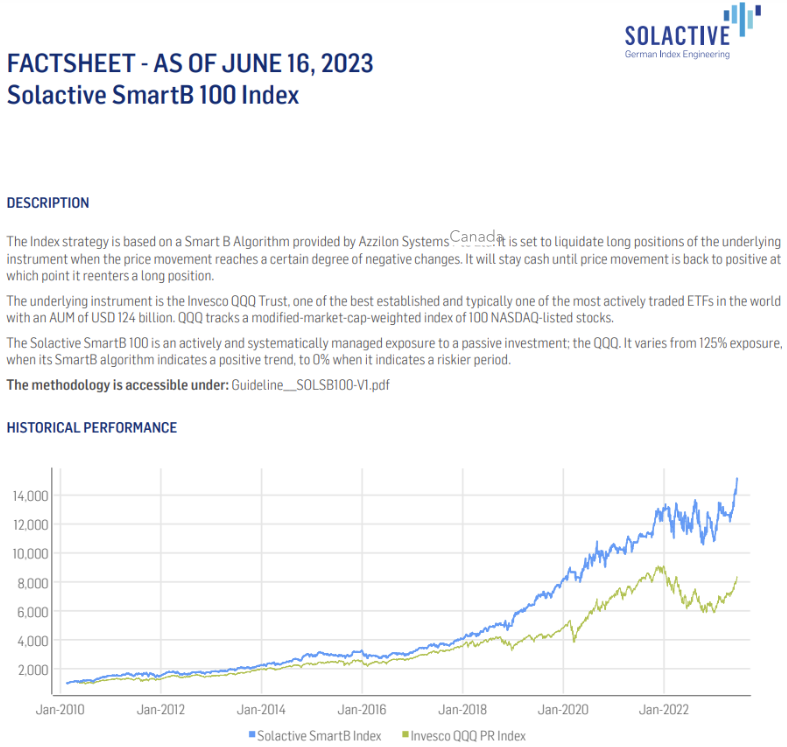

Important to note that the SmartB 100 Index, by Solactive, our very first index, is gaining in popularity as it continues to outperform the Nasdaq 100 substantially, month after month. Many projects are in development with our product team, including new crypto indices with the Singapore Index for our partner 3iQ. Furthermore, one of the largest Singaporean banks, DBS, is using the AUD USD Index, powered by Azzilon, listed on the Singapore Exchange “SGX”.

Now let’s look at gold as an investment.

Gold is on the precipice of hitting its highest price on record. Amid a rocky macroeconomic environment, investors are turning to this safe-haven asset, and analysts believe the precious metal could have much more room to run, thanks in no small part to the potential recession looming ahead.

Gold prices are up 8% this year, on pace for their best annual performance in three years. The price was up to $2,040 per ounce, just a tick behind the briefly achieved peak of about $2,075 in August 2020—when the Covid-19 pandemic and elevated geopolitical uncertainty fueled fervor for the safe-haven asset.

UBS’ global chief investment officer, Mark Haefele, predicts that the precious metal could soon soar far past its all-time high. In a recent note to clients, he set a $2,200 target for gold by next March, indicating an 8% upside.

Corporate News

In May alone, bank notes issued by JP Morgan and Morgan Stanley, linked to Azzilon Strategies on Japan and on the recession resilient portfolio, were distributed for amounts exceeding USD $40 millions. We expect this trend to continue and amplify before the calendar year ends.

We were invited by 3IQ to attend the largest BTC show in the world where we met future customers and partners. In July, 3IQ is launching their QMAP platform (Manage Account Platform) based on the Azzilon SmartB. we anticipate significant revenue from this partnership.

We were also in Paris at the Paris Fintech Forum 2023. The many conferences gave us keen insight into trends for 2023-2024 and a few meetings with various actors. Prior to the Forum, we met with the biggest asset manager in Europe to discuss how we can do business with them. Following that, we had an excellent meeting with “Le Bureau de Délégation Générale du Québec à Paris”. They want to help us with business in Paris and Europe. We have also been approached for a partnership with an asset manager in Paris that is already well established.

As mentioned, we are working on the RTO in the fall if market conditions are favorable. Our objective for the RTO is having significant revenue. As we are nicely climbing up the hill of the financial sector, our valuation and attractiveness for potential purchasers are also progressing.

Our goal is simple, build revenue to add intrinsic value to our company. The more we are in demand, the easier it becomes to generate business, and the more performance is generated by the Azzilon strategies, the easiest it becomes to sign up collaboration agreements with large organizations.

We certainly appreciate the support received by every one of the Azzilonians helping our team to pursue this objective.

Stay tuned for more updates and investment insights in our future Azzilonian newsletters.

Financial Highlights

Solactive SmartB 100

The Solactive SmartB 100 index continues to generate impressive returns, with a noteworthy 15.68% effective performance recorded this month.

For more information, please visit https://www.solactive.com/Indices/?index=DE000SL0A3F6

SmartB Japan Strategy

The SmartB Japan strategy is also returning some great results amid these decisive past months, the strategy has already cumulated a 14.22% return since its conception in May.